Mcap: ₹ 13,000 Cr D/E: 0.53 CMP: ₹ 547

About the Company:

SW Solar is one of the leading pure-play global solar EPC solutions provider and Solar O&M player. The company works from conceptualization to commissioning a solar plant and Battery Energy Storage System (BESS).

History and Reason for Losses –

Company commenced operations in 2011 and was earlier a part of Shapoorji Pallonji Group. At the time of IPO, the company had projects across almost every major solar geography – Middle East, Africa, Australia, Americas, South East Asia. If there was a large solar project in any part of the world, the company was there to bid for it. The demand for solar projects in India was thin, solar and renewables were yet to take off. International projects unlike India, which is a Balance of System (BoS) market – where procurement (primary equipment, i.e. solar modules) is the responsibility of the client instead of EPC company.

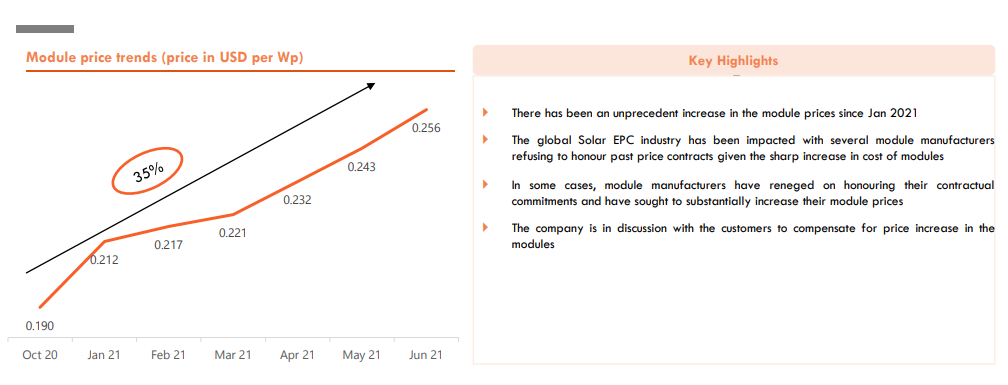

The company primarily focused on international EPC projects, generating over 80% of its revenue from exports. Most of these contracts were fixed-price, Sterling & Wilson would do everything from procurement of materials to building the required project in very specific time period. This meant that if there were any cost overruns due to delay in construction or increase in price of raw materials etc., the company had to bear all of them from its own pocket, further putting pressure on the tiny single digit EBITDA margins.

2020: Covid Outbreak – Worldwide Lockdown

As the pandemic raged across the world, Sterling & Wilson found itself in an increasingly tough spot. Unable to work at most sites due to shortage of workers or lockdowns, combined with increasing prices of solar modules and other necessary equipment, the company was forced to concede and call ‘force majeure’ on most of its contracts.

This cancelling of contracts led to multiple lawsuits as clients didn’t want to pay up for unfinished work. Sterling Wilson should have protected itself better by foreseeing and demanding specific clauses to be enabled in these contracts.

Every EPC business works on very thin margins and as such opts for short-term working capital loans to fund itself. When clients of Sterling Wilson opted not to pay, it had to default on these loans triggering a downward spiral of its credit ratings, which made future borrowing more expensive.

It also increased legal costs for the firm by many folds, as client sued, creditors sued and Sterling Wilson sued them back.

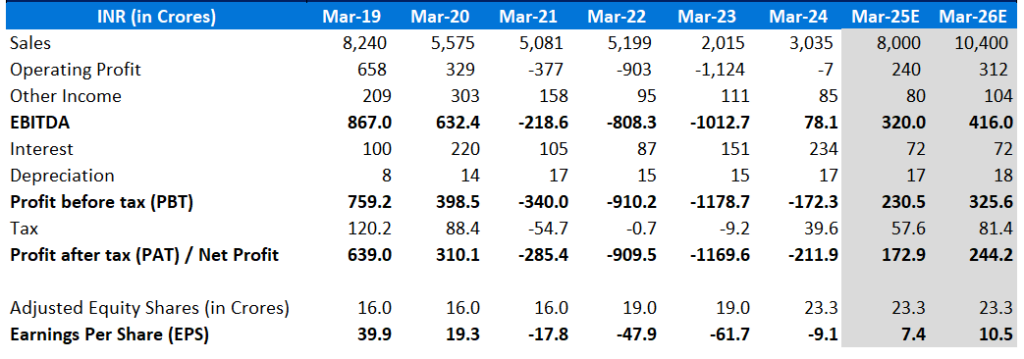

Between 2019 and financial year ending 2023, the company’s revenues dropped by 75%, from ₹ 8240 crore in 2019 to just ₹ 2015 crore. Further, the company went from positive operating margins of 8% to reporting negative margins for the next 10 quarters.

Investor Presentation Q4’21

On February 9, 2022 Reliance New Energy, a subsidiary of Reliance Industries purchased a 40% stake in Sterling & Wilson at ₹ 375/share for a total of ~ ₹ 737.5cr.

The last three years of losses have led to accumulation of total debt of ₹ 2,123 Cr in Sep 2023. The company has raised ₹ 1500 Cr via equity issue at ₹ 347/share in Nov 2023 and majority of the funds was utilized to reduce debt. Thus, net debt of the company has reduced to ~INR 27 crore as of December 31, 2023 from ~INR 2,079 crore as of September 30, 2023.

Has business turnaround?

Yes, it seems the business has turned around, as the company has reported net profits in the last two quarters after 16 consecutive quarters of losses.

Order Book – ₹ 9,396 Cr as of June 2024 Vs ₹ 8,084 Cr as of Mar 2024

Order Book Split – 71% Domestic || 29% International

Company has won two international BOS orders worth EUR 132 million (~ INR 1,100 Cr) from Plentitude in Spain and Enfinity in Italy, marking the first international orders after a gap of 3 years.

Company has learnt from past-

Indian market continues to be a BOS market. But wherever we are taking, we have taken a couple of projects in domestic market with modules, but we are taking extreme cautions with Indian projects.

Company have taken on some projects that include modules, with a strong emphasis on minimizing risk by:

1. Using Trusted Indian Manufacturers: They are selecting only manufacturers with whom they have long-standing relationships, ensuring contractual reliability.

2. Bank Guarantees: The company has implemented strict financial measures, such as securing bank guarantees, to mitigate any risks.

3. Selective Project Choice: They are being highly selective about the projects they undertake in India, ensuring they can manage the module-related risks effectively.

For international projects, they are being even more cautious, shifting risks onto customers and requiring significant bank guarantees (up to 15%) while choosing multiple module manufacturers (at least three) to spread the risk.

Timeline of Order book Execution-

| Type | International | Domestic |

| Larger Project (>1GW) | 18 months | 15-18 months |

| Smaller Project | 10-14 months | 6-8 months |

Payment Structure/Timeline – (Source: Credit Report)

- SWREL receives 15% of the contract value as a customer advance to mobilize the project at the site.

- After that, they receive about 75% on the supply of materials to the site. This is a significant portion of the payment early in the project lifecycle, giving the company enough cash to cover the costs of materials and related expenses.

- The remaining part of the payment is likely linked to the installation and commissioning of the project, which happens later in the project lifecycle.

Need of Bank Guarantee (Non- fund limits)-

- Advance Bank Guarantee secures the repayment of advance money in case the contractor fails to begin or continue the work.

- Performance Bank Guarantee secures the quality and completion of work, ensuring that the contractor fulfills their contractual obligations. SW Solar provides around 10% of project value as Performance Bank Guarantee.

- Letter of Credit to suppliers are used to purchase key equipment (e.g., trackers, steel, inverters) and have shorter durations (90-120 days). These LCs are continuously being issued and then paid off.

In short, the company needs around 45-50% of project value as a Bank Guarantee at its peak and then it will fall for a project.

As of Q1’24 concall, the company has The total non-fund limits are between INR 5,500 crores to INR 6,000 crores and roughly INR 3,800 crores to INR 4,000 crores stand utilized. To execute order book of around ~9,000 Crore and above, the company need to increase Non-Fund Limits which highly depends on the credit rating of the company.

Due to historical defaults, the company credit rating was downgraded to D but got upgraded to BB+ (still not in investment grade). Management mentioned that “we will be pushing for a higher upgrade into the investment grade which gives us the confidence for unfreezing of the rest of the limits.”

Competitor Analysis:

Solar EPC business is a competitive business. Some listed competitors are Waaree Renewable, Oriana Power, Gensol Engineering.

Margin Comparison-

| Company Name | Mar-22 | Mar-23 | Mar-24 | Mar-25E |

| SW Solar | -16% | -50% | 3% | 4% |

| Waaree Renewable | 15% | 24% | 24% | 15% |

| Oriana Power | 10% | 14% | 21% | – |

Waaree and Oriana has much higher EBITDA margins as they operate on relatively small and domestic projects. Domestic projects have higher margins and relatively shorter execution timeline.

Waaree in Q1’25 concall mentioned about margins-

“We keep constantly getting a question on why our margins are, and, we are being constantly producing those kinds of margins. There are two sets of things that we need to look at. We have been very long in this business and we are done cautiously, we don’t tend to go below a particular internal benchmark margin in all our projects. We don’t get into projects for the sake of just bringing in revenues. That’s one of the reasons. And second reason, of course, is that we have developed a strong ecosystem of vendors. The third, of course, you should leave some secretes it to us, as businessmen, that we want to produce value for our stakeholders.”

Waaree parent company (Waaree Energy) has Module and cell capacity-

- Module Capacity = 12 GW

- Cell Capacity = 5.4 GW

Avg Realization per MW = Rs 1-1.2 Cr

Oriana- Company also operates on RESCO model

In RESCO model, company owns, operates, and maintains the solar power system, while the customer (which could be an individual, business, or institution) pays for the energy generated without having to invest in the upfront capital costs of the system.

All the Investment, Commissioning and maintenance are done at our end and in lieu of that our company sells power to the end consumer through a Power Purchase agreement generally agreed for 25 years.

Capex Cost: Rs 4.5 cr for 1 MW of solar plant

Cost per unit varies from INR 4 – INR 6

Order Book Comparison

| Oriana | Waaree | Gensol | SW Solar | |

| Order Book (In Rs Crore) | 600 | 2,500 | 1,500 | 9,396 |

SW Solar is a biggest EPC player and one of the few players to execute 1GW + projects.

O&M Portfolio Comparison –

Waaree Renewable = 500+ MW || 2 GW by FY’25

SW Solar = 8.2 GW as of Jun’25

Peer Valuations – (Waaree and SW Solar are pure play EPC, while Oriana have biomass & Gensol have EV business)

| Company Name | SW Solar | Waaree Renewable | Oriana Power | Gensol |

| EV/EBITDA | 99.4* | 76.9 | 49.8 | 14.6 |

| P/S | 3.7 | 18.7 | 10.5 | 2.8 |

Future Optionality in SW Solar business:

- The Nigeria MOU was announced in Sep’22 which is funded by Exim Bank of U.S.A in the African continent has a revenue potential of ~1.5 to 2 billion USD (Rs 12,000 – 16,000 Crore) for the company. As per the management, the final terms have been negotiated and procedural steps are in progress which would take nearly 6 months to achieve financial closure due to various US institutions also involved. Revenues will be recognised next FY26.

- Reliance had announced renewable energy targets of 100 GW by 2030 (solar being major), this will provide a huge opportunity for the company. Management has created a particular SBU for Reliance. The company has completed a pilot project, and teams are continuously engaged with Reliance on rollout of mega projects in various regions in the country.

- The O&M portfolio grew from 7.67 GW in March 2024 to 8.2 gigawatts as of June 2024 whose fruits are expected to come in 12-18 months and thus can lead to margin expansion. O&M has better gross margin of ~ 15%.

- Solar + BESS (Battery Energy Storage System) is also a huge opportunity for the company with BESS margins to be very high (For example the BESS EBITDA margins for Gensol Engineering, a similar company, is around 90%)

In Q4’24 concall management mentioned following for BESS segment –

“So, actually the company already has capability to execute EPC project for battery energy storage systems. We have executed similar projects in Africa and we were bidding for these projects in multiple geographies, and we expect this market to come up significantly in India, for which we have, which has not been factored into our projection so far.

We expect this market to grow significantly and we have in-house capabilities to address this market. So, because we started working many years back on this particular BESS part and we are technology agnostic and we can address BESS projects, including any technology in any geography, so we are fully geared up for that.”

Key Risks for the company:

Company has 3 promoters (SP group, Khurshed Daruvala and Reliance)-

SP group and Daruvala are continuously selling their shares and pledging left right and center.

On 22 Sep 2024, CFO Bahadur Dastoor resigned from the company who was with SP group since 2010. Recent exit of CFO, reducing stake of SP group (to service their high debt levels) clearly indicates some power tussle inside the company.

What is wrong with SP group?

Shapoorji Pallonji as a group is having multiple businesses. They are under huge debt which needs immediate payments and restructuring. The group has already raised ~ Rs 32,000 crore from global private credit funds and HNIs over the last 3 years via NCDs.

SP group has reached out to PFC for refinancing its existing debt and PFC was considering to issue loan against unlisted shares of Tata Sons, but PFC independent directors objected it. (Source).

SP group has also tried to get funds from IPO of Afcons Infra to which SEBI objected. SP group had also taken the loan of Rs 790 crore from IPO proceeds of SW Solar in 2019 and promoters defaulted on the loan.

Overhang of Contingent Liability–

Under its engineering, procurement and construction (EPC) contracts, SWREL extends performance bank guarantees (BGs) for each of its projects ranging in 10%-15% of contract value. These BGs usually extend till the defect liability period. As on 31 December 2023, the total outstanding BGs were about INR28.6 billion. As these BGs are unconditional, the counterparty can invoke them even when SWREL does not agree to the reasons of invocation. SWREL faced such invocation of BGs amounting INR3.9 billion in July 2023 and INR0.9 billion in February 2024. As of 14 February 2024, about INR3 billion of BG were outstanding with the customer wherein the company is in dispute. In case of any such BG getting invoked, it will impact the liquidity of the company and hence this will remain a key rating monitorable.

Management Guidance and Future Outlook-

Management mentioned that they are confident of Rs 8,000 Cr revenue in FY’25, with gross margin of around 10-11% and EBITDA margin of 4-5%.

Below projections are excluding any orders from Nigeria MOU and Reliance. Company has also mentioned to grow 20% YoY and double FY’25 (i.e. 8,000 cr) revenue in next 3-4 years without including Nigeria and Reliance projects. Management has also guided for long term EBITDA margin of 7-8%.

Conservatively estimating it based on Price to sales of 3, the company Mcap should be around Rs 31,200 cr in Mar’26. This provides an estimated return of ~140% in next 18 months.

Considering the potential risks and the embedded optionality in the business, SW Solar appears to be a compelling turnaround story. The real advantage would come if Reliance, which already holds a majority stake, takes full control of the company, further accelerating its growth and strategic direction.